AI

AI Autumn Marks the Start of Real Change

If you’ve been feeling anxious about AI adoption—or perhaps secretly relieved by recent headlines suggesting it’s finally cooling off—there’s news that might surprise you. The data everyone’s interpreting as a “slowdown” is actually something far more significant: AI is maturing.

The Headlines That Started the Conversation

Recent U.S. Census Bureau data shows AI adoption among large enterprises dropped from 14% in June to under 12% by August 2025. It’s the first notable pause we’ve seen in corporate adoption rates, and the headlines wrote themselves: “AI Adoption Is Declining,” “Is the AI boom finally starting to slow down?.”

For those who’ve been struggling with the 8 stages of AI adoption—perhaps stuck somewhere between denial and depression—this felt like validation.

But here’s what’s actually happening: AI isn’t slowing down. It’s growing up.

Welcome to the Trough of Disillusionment

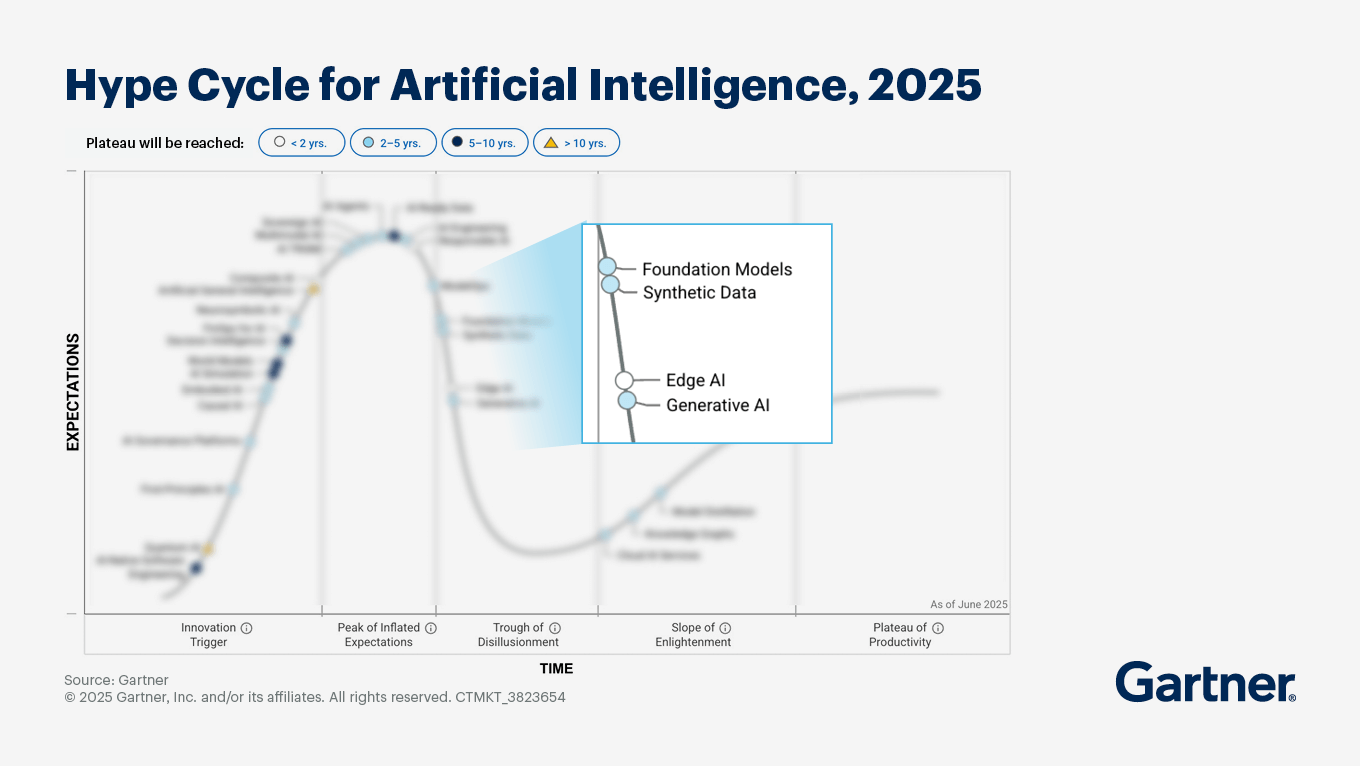

If you’re familiar with Gartner’s Hype Cycle , you’ll recognize exactly where we are. AI technologies—especially generative AI—have descended from the Peak of Inflated Expectations and are now firmly planted in the Trough of Disillusionment.

This isn’t failure. It’s the most predictable phase of any transformative technology.

According to Gartner’s 2025 Hype Cycle for Artificial Intelligence, generative AI is experiencing exactly what every major technology breakthrough experiences: the collision between sky-high expectations and messy reality. Fewer than 30% of CEOs report satisfactory ROI on AI initiatives despite average investments of $1.9 million per project.

But here’s the critical insight most people miss: the Trough of Disillusionment is where the real work begins. It’s where hype gives way to engineering. Where pilots become production systems. Where “wouldn’t it be cool if…” transforms into “here’s exactly how we’ll measure success.”

This maps perfectly to the change curve outlined in the previous post about AI adoption stages. Companies aren’t rejecting AI—they’re moving from Depression (the painful adjustment phase) toward Acceptance and Integration. The grief process doesn’t mean you’re giving up; it means you’re finally getting real.

Two Very Different Stories About “Slowdown”

To understand what’s really happening, we need to distinguish between two completely different phenomena:

- Subscription Saturation (Surface-Level)

Yes, ChatGPT Plus subscriptions may have plateaued. The early adopters—the tech enthusiasts, the productivity hackers, the curious professionals—have already signed up. That market segment is saturated.

This is the visible “slowdown” everyone’s measuring. Fewer new corporate AI pilot programs. Less breathless experimentation with every new model release. A pullback in broad, unfocused generative AI spending.

- Workflow Integration Lag (Deep-Level)

But here’s what the headlines miss entirely: the true power of AI hasn’t been realized yet.

Most people with AI subscriptions are still treating them like fancy search engines or writing assistants. They open ChatGPT in a separate tab when they remember to. They occasionally ask Claude for help with an email. They’ve maybe tried GitHub Copilot a few times.

The gap between these two phenomena is enormous. And it’s where both the greatest risk and the greatest opportunity currently exists.

What’s Actually Happening: AI Autumn

While enterprise adoption rates show a modest dip, the global AI market tells a completely different story:

- The AI market is projected to hit between $243-407 billion in 2025, representing 23-27% compound annual growth

- Manufacturing AI is growing 45% year-over-year

- Retail automation alone will reach $27 billion in 2025

- VC funding for AI ventures remains at record proportions despite overall fundraising volumes dropping 40%

Analysts are calling this phase “AI Autumn”—and the metaphor is remarkably apt.

Understanding the Seasons of AI

Just as autumn follows summer’s peak heat with cooler temperatures and clearer skies, the AI industry is moving from the sweltering hype of 2023-2024 into a season of clarity and consolidation. Diplomacy.edu frames it perfectly in their analysis “From Summer Disillusionment to Autumn Clarity,” describing this as a period where expectations reset and the field transitions from hype to grounded, practical business advances.

This isn’t the frost of winter—it’s the harvest season. After the explosive growth phase (spring and summer), autumn is when you separate what actually grew from what was just weeds. It’s when mature fruit gets picked and stored for long-term value.

This isn’t retreat. It’s recalibration. And historically, the autumn phase—the consolidation period after initial hype—is when transformative technologies become genuinely transformative. The internet had its autumn. Cloud computing had its autumn. SaaS had its autumn. In each case, the cooling period was followed by the most significant period of actual value creation.

Large enterprises aren’t abandoning AI; they’re shifting from broad experimentation to targeted, ROI-driven deployments. They’re moving from “let’s try AI for everything” to “let’s solve these three specific problems with AI, measure the results, and scale what works.”

Meanwhile, employee-level and small-business adoption continues to rise, especially in back-office automation, marketing, and finance functions. The technology is expanding horizontally into new industries and use cases—it’s just doing so more quietly and strategically than the 2023-2024 explosion phase.

The Uncomfortable Truth for Non-Adopters

Here’s where honesty is essential: this is not permission to ignore AI.

If you’ve been in the Denial or Resistance stages of the adoption curve, it would be easy to misinterpret the current moment.

But that interpretation is dangerously wrong.

The maturation phase—this Trough of Disillusionment—is actually when competitors pull ahead. While the hype-chasers are retreating and the laggards are celebrating their inaction, the strategic adopters are building competitive moats.

They’re the ones who:

- Learned from failed pilots and are now deploying AI systems that actually work

- Built the data infrastructure and governance frameworks necessary for responsible AI

- Trained their teams not just to use AI tools, but to think differently about problem-solving

- Established workflows where AI augments human judgment rather than replacing it

When fewer than 30% of CEOs report satisfactory ROI on AI, that doesn’t mean AI doesn’t work. It means 70% of implementations are immature. The question is: do you want to learn from their mistakes now, or make your own mistakes three years from now when everyone else has figured it out?

From Hype to Habit: The Real Transition Ahead

Gartner’s model shows that no core AI technologies have yet reached the Plateau of Productivity. But they’re climbing toward it:

In the Trough: Generative AI, foundation models, synthetic data—facing ROI and scaling challenges

On the Slope of Enlightenment: Knowledge graphs, model distillation, cloud AI services—showing clear business value through steady deployment

At the Peak: AI engineering, AI-ready data, autonomous agents—the next wave of inflated expectations

By 2028, Gartner projects that more than 95% of enterprises will use some form of generative AI in production environments. The question isn’t whether AI will become ubiquitous—it’s whether you’ll be leading or following when it does.

What to Do Right Now

If You’re Already an Adopter:

- Stop collecting subscriptions. Start embedding workflows.

- Having a ChatGPT Plus account doesn’t make you AI-enabled any more than owning a gym membership makes you fit. The transformation happens when you fundamentally redesign how you work

- Identify your three highest-leverage repetitive tasks

- Build AI-augmented workflows around them (not just “use ChatGPT sometimes”)

- Measure the time savings or quality improvements

- Iterate and expand

- Focus on integration over experimentation. You’ve passed the “wow, this is cool” phase. Now it’s time to build systems that compound your capabilities over time.

If You’re a Non-Adopter:

This is your window.

The Trough of Disillusionment is actually the ideal time to enter. The hype has cleared. Best practices are emerging. The tools are more stable. The ROI patterns are clearer.

You don’t need to be an early adopter to win with AI—but you do need to be a strategic adopter. Use the change curve framework:

- Move beyond Denial: Accept that AI will transform your industry

- Push through Resistance: Start with small, low-risk experiments

- Survive the Depression: Expect early failures; learn from them

- Reach Acceptance: Commit to serious integration, not just dabbling

- Build toward Integration: Make AI a core part of how you operate

The companies pulling back from AI aren’t the ones who approached it strategically. They’re the ones who chased hype without foundations, who deployed AI without governance, who expected magic without doing the engineering work.

The Real Story

AI adoption isn’t slowing down—it’s evolving from explosive expansion to sustainable integration.

The broad, exploratory phase of 2023-2024 is giving way to targeted, value-focused deployments. Globally, the AI market continues to surge in size and maturity. Investment remains strong but more concentrated on proven use cases.

This transition from hype to habit, from fascination to function, from Peak to Trough to Slope—this is what maturation looks like. It’s messy and it’s uncomfortable and it doesn’t make for exciting headlines.

But it’s also when the real value gets created.

The question isn’t whether AI adoption is slowing down. The question is: when this technology reaches the Plateau of Productivity in the next 2-3 years, will you be positioned to benefit from it, or still explaining why you decided to wait?

The choice, as always, is yours. But please don’t mistake maturation for failure, or a market correction for a trend reversal.

AI is getting real. That’s exactly when you should be paying the most attention.

Find out more About Cyferd

New York

Americas Tower

1177 6th Avenue

5th Floor

New York

NY 10036

London

2nd Floor,

Berkeley Square House,

Berkeley Square,

London W1J 6BD